Ok, in my last post about my plan for financial independence at age 30 I offered what would be necessary in terms of asset growth to meet my goals. But, I didn't offer any solutions to meet those milestones beyond the first year.

So, first I thought "I didn't include yearly contributions, that's got to lower the rate of return necessary to meet my goals." So, I re-built my model - updated version available

here (make sure you look at sheet 2, it has the yearly contribution model).

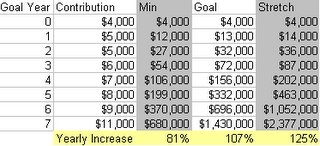

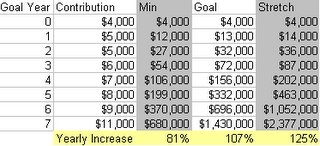

I put in 7 years, $1.43 million, $4,000 annual contribution growing at 15% a year for the goal, and keeping everything else the same put in $700,000 and $2.4 million for my minimum and stretch goals.

Results:

Plan: Stock Market - Nope

Plan: Stock Market - NopeNot quite as insane as the first time around, but definitely not the 10% yearly return that the S&P might give if it keeps its historical return. Only about four times the returns of small caps on average.

107% compounded annually is not possible in the stock market.

Plan: Save more each year - Not likelyEven with a leveraged options based strategy, the most I can get for the risk I am willing to take would be around 22% a year pre tax- I'll go into that strategy at a later date. So, at what rate would I have to increase my contributions at 22% to make my goals? To answer this I used the Excel function

Goal Seek (Tools > Goal Seek).

To meet my goal, I would have to increase my contributions at 104% a year ending at $583,000 in year 7 (Minimum 79% & $233,000, Stretch Goal 123% & 1.1 Million).

If I keep my living expenses completely flat, and my salary increases at 17% a year (starting from $55K, yeah I got a plum job out of college) and I save every penny then I

could meet my minimum target if I can get 22% a year returns. Unless I can wind up CEO of a Fortune 500 company in 7 years, it is not likely that I will meet my goal by saving more.

Plan: Sell Drugs - Absolutely notI refuse to engage in illegal activity (what good is $1,000,00 if you're in jail for 20 years even if you get the money when you get out), so I can't get these kinds of returns there. Some people might be able to, but I certainly am not going to.

Plan: ?

Right about now, it might seem that I have an insane plan that nobody could accomplish. But, this kind of return has been achieved before.

Plan: Real Estate - Perhaps

In Rich Dad Poor Dad (buy, my review), Kiyosaki says he turned $5,000 into $1,000,000 producing $5K a month in 6 years using rental properties (Ch. 10, p. 254). Assuming he stayed true to his definitions of assets and liabilities, then this is money in his pocket after paying the mortgage and expense. $5K a month is twice what I estimate I need on a monthly basis to consider myself financially independent (i.e. retired). So, it could be done in real estate.

Plan: Start a business - Probably

According to thisarticle in Forbes, the record ascent to billionaire is 18 months by Garry Winnick of Global Crossing (followed by bankruptcy, but who's counting). The Google guys did it in 7 years, Amazon was 4 years, Ebay only took 3.

I don't think I'll be able to come up with an internationally known internet brand any time soon (although the idea of a retire at 30 blog IPO is quite humorous). But, if they were able to go 0 to a billion in the time that I'm trying to do 0 to a million, then there is hope.

When you look at the Young Entrepreneurs Network, and see that their minimum standard for membership is a company with $1 million in annual sales. Then you think that the price-sales ratio of venture backed company ranges from .25 to 1 (see ventureline analysis of small business valuation techniques), and you start to think, this might be possible.

Plan: Wage slave - Never

Moral of the story: You are never going to reach financial independence at 30 if you stay as a wage slave. If you spend your spare time working on side businesses (such as real estate), then there is a fighting chance.

My Plan: Real Estate + Small Businesses + Stock Market + Work Hard + Frugal Living.

I am not going to go into the details of what my businesses are exactly. In college I ran a few, and had quite good success - they were all non-profits so I didn't keep a dime of the profits I generated, but I did learn enough about running organizations, finances, working on teams, etc. to have a lot of confidence in my ability to do this.

One of the things that I will be sharing in this blog, are the tips and tricks I come across as to how to be successful at running organizations (read businesses).

Tip 1: In college and after, do things that are going to force you to learn about running organizations not just about the esoteric substance of your major. Take over as treasurer of an organization and you will probably hate the experience, but learn more real world financial planning tricks and techniques than you could anywhere else.

Tip 2: In the same vein: what you do with your free time is up to you. You can choose to spend it becoming a more savvy investor, researching businesses, and creating a plan for financial success. Or, you can watch TV. Your choice.

I have a TV in my bedroom. I have turned it on once in the past 6 months. I am going to retire at 30.