Idea:Sell pixels on your website

Example: www.milliondollarhomepage.com

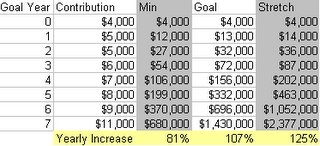

Value of Idea: $1,000,000 - 5 years hosting (likely free) - Taxes (likely around 30%) = $700,000

Time to Million: 6 Months

Replicable: Not really, but it has been tried dozens of times. Replication potential in Niche content areas, other geographic regions, and especially other major languages (spanish and chinese come to mind).

Sustainable: Yes and no. You can pull this stunt once, but after that it is hard to create another million dollar page. It is a one-time stunt.

Passive: Yes.

Extendible: No.

Why it Works:

This is a fascinating example of how one person can create $1,000,000 in wealth for themselves by creating value for other people in a new and previously un-recognized manner.

This site serves as a coordinator for two groups: 1) people looking for something on the internet and 2) sites trying to get traffic.

What the creator of this site has done is solve a connection problem. There are millions of poeple who are just surfing the net looking for some form of interesting stimulation without caring what it is. There are also countless millions of sites out there providing entertaing or somehow valueable products that these people would like. They connect procrastinators with websites.

Users: If there were a random button that people could push to get an interesting site, many would. This website functions as a novel approach to creating a random button.

Advertisers: On the other side of the coin, the internet is largely a numbers game. The more people who visit your site, the more people who are likely to find your content interesting and do something that will make you money (buy a product, join a community, further click on your ads). In the physical world the addage "Location Location Location" came from this fact: the more people who walk past your storefront --> more people comming in --> more people buying things.

This site's value derives from the fact that they connect people who are just looking for something to do with sites that just want traffic.

The major obstacle to implementation here is a coordination problem. If there are enough random sights, then people will come. If there are enough sites, then sites will advertise.

I am not 100% clear on how this site overcame that problem, but somehow they did. Once they reached critical mass on one side, they then got critical mass on the other and the site became self perpetuating.

Congratulations to the owner of this site. You became a millionaire by having a great idea that nobody else before you saw.

It is a rare mind indeed that can render the hitherto non-existent blindingly obvious. The cry 'I could have thought of that' is a very popular and misleading one, for the fact is that they didn't, and a very significant and revealing fact it is too.

Douglas Adams